Harmonization of accounting standards across countries will – Harmonization of accounting standards across countries has emerged as a crucial endeavor, promising to transform the global financial landscape. By aligning accounting practices, we pave the way for improved transparency, enhanced comparability, and reduced compliance costs, ultimately fostering a more robust and interconnected international business environment.

This comprehensive analysis delves into the benefits, challenges, and impact of harmonizing accounting standards on international business, examining the role of key organizations such as the International Accounting Standards Board (IASB) and regional harmonization initiatives. Furthermore, it explores future trends and provides recommendations for continued progress towards global accounting uniformity.

Harmonization of Accounting Standards Across Countries

The harmonization of accounting standards across countries is a critical aspect of global financial reporting. It involves aligning accounting practices to ensure consistency and transparency in financial reporting, facilitating cross-border transactions, and improving the comparability of financial statements.

Benefits of Harmonized Accounting Standards

Harmonizing accounting standards offers numerous advantages, including:

- Improved Financial Reporting Transparency:Consistent accounting practices enhance the transparency and reliability of financial statements, enabling investors, creditors, and other stakeholders to make informed decisions.

- Reduced Compliance Costs:Multinational corporations operating in multiple jurisdictions benefit from reduced compliance costs as they can adopt a single set of accounting standards.

- Increased Financial Comparability:Harmonization facilitates the comparison of financial statements across companies and countries, enabling investors to assess performance and make informed investment decisions.

- Successful Harmonization Initiatives:Notable examples of successful harmonization initiatives include the International Financial Reporting Standards (IFRS) and the European Union’s Accounting Directives.

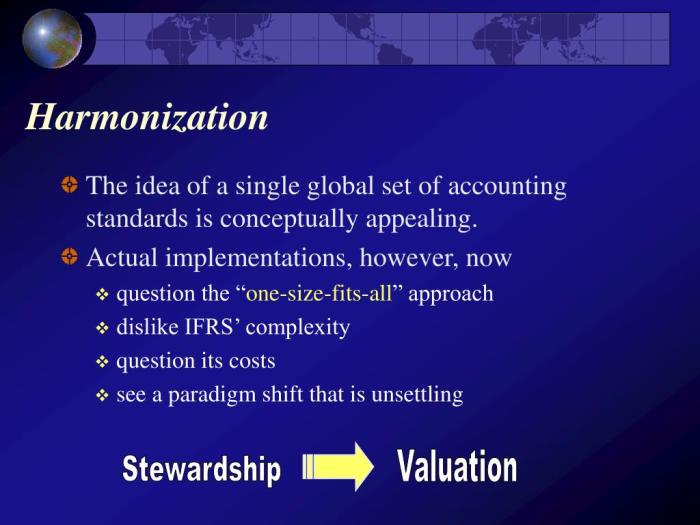

Challenges of Harmonizing Accounting Standards

Achieving global accounting uniformity presents several challenges:

- Cultural and Legal Differences:Cultural and legal variations influence accounting practices, making it difficult to establish a universal set of standards.

- Role of National Regulatory Bodies:National regulatory bodies play a significant role in shaping accounting standards, often influenced by local economic and political factors.

Impact on International Business

Harmonized accounting standards significantly impact international business:

- Facilitated Cross-Border Transactions:Consistent accounting practices simplify cross-border transactions by reducing the need for adjustments and reconciliations.

- Reduced Compliance Costs:Multinational corporations can streamline their compliance efforts and reduce costs associated with adhering to multiple accounting frameworks.

- Improved Financial Comparability:Harmonization enables the comparison of financial statements across countries, aiding in evaluating the performance of foreign subsidiaries and making investment decisions.

- Industry-Specific Impacts:Harmonization has particularly impacted industries with significant cross-border operations, such as banking, insurance, and manufacturing.

Role of International Accounting Standards Board (IASB): Harmonization Of Accounting Standards Across Countries Will

The International Accounting Standards Board (IASB) plays a crucial role in global accounting harmonization:

- Mission and Objectives:The IASB’s mission is to develop and issue high-quality, globally accepted International Financial Reporting Standards (IFRS).

- Process of Developing IFRS:The IASB follows a rigorous process involving extensive research, public consultation, and due process to develop IFRS.

- Influence of IFRS:IFRS has become the global benchmark for accounting standards, adopted by over 140 countries worldwide.

Regional Harmonization Initiatives

In addition to global efforts, regional accounting harmonization initiatives have emerged:

- European Union’s Accounting Directives:The European Union has implemented a series of Accounting Directives to harmonize accounting practices within the EU.

- Goals and Scope:These initiatives aim to enhance financial transparency, comparability, and facilitate cross-border transactions within their respective regions.

- Challenges and Successes:Regional harmonization efforts face challenges related to cultural and legal differences, but have achieved significant progress in promoting consistency within their regions.

Future of Accounting Harmonization

The future of accounting harmonization holds several potential trends:

- Impact of Technology:Advancements in technology, such as data analytics and blockchain, may accelerate the convergence of accounting standards.

- Globalization:Continued globalization will drive the need for harmonized accounting practices to facilitate international business transactions.

- Recommendations for Progress:To further global accounting uniformity, continued collaboration among international organizations, national regulatory bodies, and the business community is essential.

FAQ Section

What are the primary benefits of harmonizing accounting standards?

Harmonization enhances transparency, improves comparability, reduces compliance costs, and facilitates cross-border transactions.

What challenges hinder the harmonization of accounting standards?

Cultural and legal differences, the influence of national regulatory bodies, and the complexity of international accounting practices pose challenges.

How does harmonization impact multinational corporations?

Harmonization benefits multinational corporations by reducing compliance costs, improving financial comparability, and facilitating cross-border operations.